Calculating hours worked isn’t as easy as pulling up a calculator and adding numbers. If you’re in charge of time tracking, you know it calls for precision and patience. And each employee’s hours chart presents multiple opportunities for errors and slip-ups, every single pay period.

Pay miscalculations through inaccurate hour calculations can lead to compliance lapses, employee churn, and snowballing costs — each payroll error costs an average of $291. But calculating work hours gets complicated when you’re managing mobile/hybrid workforces, differing pay rates, overtime, and multiple time tracking methods.

Adding to the complexity?

- Federal, state, and local compliance

- Laws at each level around breaks, overtime, and time off

- Union collective bargaining agreements (CBAs)

The consequences of compliance failures can involve legal action, fines, and reputational damage.

Fortunately, there’s no shortage of tools and methods to help. In this article, we’ll provide a step-by-step breakdown of how to calculate hours worked. We’ll also touch on different time tracking tools you can use to track employees’ hours, with considerations on how to choose the best one for your organization.

How to calculate hours worked in 6 steps

Calculating hours worked for employees doesn’t mean you always need a high-tech solution. By determining start and end times, converting to military time and decimals, and subtracting unpaid breaks, you can do simple math to determine total work hours.

We’ll go over each step in detail below.

Step 1: Determine start and end time

The first step is to establish when an employee started and stopped working — “clocking in” and “clocking out” times. For example, an employee might begin working at 8:30 a.m. and finish at 5:00 p.m.

Employees might log these times using a punch card, timesheet, or digital time clock. We’ll discuss these different methods in more detail later.

Step 2: Convert standard time to military time

Standard time formatting makes calculating hours worked more challenging. Converting to military time simplifies the numeric values since it’s based on a 24-hour clock and each hour in the day has its own number without am and pm denotations.

Converting to military time is easy — simply add 12 to all pm hours. So, 3:00 p.m. becomes 1500 and 8:45 p.m. becomes 2045. For employees who started at 8:30 a.m. and ended at 5:00 p.m., these hours would appear in military time as 0830 and 1700.

The table below shows the conversion from standard to military time for each of the 24 hours in a day:

Step 3: Convert digital time to decimal hours

The real benefit of converting to military time comes with pay calculations later on — work duration must appear as a number, rather than as hours and minutes. Because an hour is 60 minutes long, converting to decimals is simple: divide the number of minutes by 60.

For example, if an employee stopped working at 1730, divide 30 by 60 to get .5, so the end time would be 17.5.

- 1715 = 17.25 (divide 15 by 60 minutes)

- 1700 = 17 (divide 0 by 60 minutes)

- 0839 = 8.65 (divide 39 by 60 minutes)

By making this conversion, subtraction in the next step will be much easier.

Step 4: Subtract decimal start time from decimal end time

Now that you’ve successfully converted from standard to military time and minutes to decimals, you can subtract the start time from the end time.

If the start time was 0830 and the end time was 1700, subtract 8.5 from 17: 17 – 8.5 = 8.5.

Step 5: Subtract unpaid breaks

The next step is to subtract any unpaid breaks, and you can use the same steps listed above to calculate the length of the break. For example, if an employee’s break started at 1330 and ended at 1400, the break was 30 minutes long, converting to .5 hours.

For the employee whose workday lasted 8.5 hours, subtracting a .5-hour-long break would yield 8 hours worked.

Step 6: Calculate total hours worked

Once you’ve calculated the total hours worked for each day, you can add the hours across all the employee’s days within the pay period. Let’s say the employee in our example above worked for 10 days total during the pay period.

For four of those days, the employee worked 8 hours. For six of the days, the employee worked 8.5 hours. So the manual breakdown of hours would look like this:

8 + 8 + 8 + 8 + 8.5 + 8.5 + 8.5 + 8.5 + 8.5 + 8.5

4(8) + 6(8.5)

32 + 51 = 83

With this math, you now know that the employee worked 83 hours total during the pay period.

Bonus step: Set a rounding policy

Via the Fair Labor Standards Act (FLSA), you can round the time worked by your employees to the nearest quarter hour to simplify time tracking. For example, times between 8:01 and 8:07 may be rounded down to 8:00, and times between 8:08 and 8:14 may be rounded up to 8:15.

Be careful when rounding times so that the calculated hours are less than the actual total hours worked. This may violate FLSA rules on overtime or minimum wage pay.

How to track overtime

Some of your employees might be eligible for overtime pay — the compensation for working beyond a set limit per day, week, or pay period. Depending on the employee’s pay type, compensation, and other factors like job duties, employees are classified as exempt or non-exempt. Only non-exempt employees can receive overtime pay.

To make matters more confusing, there are three different types of overtime pay: time off in lieu, voluntary overtime, and compulsory overtime. In the simplest scenarios, overtime rates become necessary when non-exempt employees work more than 40 hours in one week.

What is the overtime rate?

Generally, overtime pay is set at a rate of 1.5 times the employee’s normal rate, according to the FLSA.

However, the FLSA isn’t the only law regarding overtime. Some states have their own overtime laws, like Alaska, California, and Colorado. In California, for example, employees receive 1.5 times their pay rate for every hour worked past an eight-hour shift, with double time after 12 hours.

Some states have industry-specific overtime rules. In Oregon, employees in manufacturing establishments receive overtime when working more than 10 hours in one day.

How to calculate overtime pay

When calculating overtime pay, take the following steps:

- Research state and local regulations based on your location(s) and industry(s)

- Understand each employee’s non-exempt status, department, pay rate, locations (if they move between cities or states), and job code

- Incorporate additional rules from CBAs

If accurately calculating overtime pay seems daunting, consider using time tracking software to reduce potential errors. Calculating hours worked is more straightforward with clear steps. However, ensuring accuracy is still a challenge and requires accurate time collection.

Different methods to calculate hours worked

There is no “right” way to calculate hours worked, and we’ll cover four different methods. The best system for your organization will depend on your operations, types of employees, and existing technology. For more on tracking employee hours, read our in-depth review of time tracking strategies.

Manual timecards

Manual timecards are just what the name implies — employees handwrite their start and end times on a timecard for each shift. Each employee will need to record precisely any breaks, days off, or variations from their regular schedule.

Handwritten timecards work well for small companies where all employees work from the same location. However, for larger organizations with distributed employees, handwritten timecards may not match your organization’s complexities.

Spreadsheets and online timesheets

Spreadsheets can reduce the overhead for calculating hours worked. Thanks to formulas and pre-built solutions like online timesheets, the steps outlined in the previous section become faster with fewer mistakes.

However, spreadsheets or timesheets may not easily account for scenarios like blended overtime, compensatory time, and overtime thresholds. Plus, if you manually enter values from handwritten timecards, the overhead admin hours can be immense with a high potential for user error.

Payroll software

As its name indicates, payroll software helps you track employees’ time and run payroll, potentially creating efficiency gains. However, payroll software can be more expensive, and subscriptions might include unnecessary features.

Depending on your organization’s requirements, payroll software may not be able to comply with CBAs, industry-specific regulations, and state-level laws.

Time clocks and time-tracking software

Employee timekeeping solutions fall into two categories: physical and digital.

Physical versions often come in the form of time clocks, where employees punch in and punch out for shifts and breaks. These work well with small, co-located teams, but employers must still enter data into a digital format to calculate hours worked (and ultimately run payroll).

For any organization with more than a few employees in one location, timecards quickly become too cumbersome, and any manual data entry can introduce human error. As a result of these drawbacks, time tracking software has become more popular.

Employees can access digital time clocks through a website or a mobile app to clock in and out regardless of location. These digital time clocks can handle the complexities of your time and attendance platform, automatically calculating employee hours while integrating with payroll providers.

Automating how you calculate work hours

Through the steps above, we’ve covered how to calculate hours worked for employees. Due to the natural downsides of manual processes, you may decide not to use our suggested methods to track hours. Another option is to automate the process by connecting tools across scheduling, time tracking, and payroll.

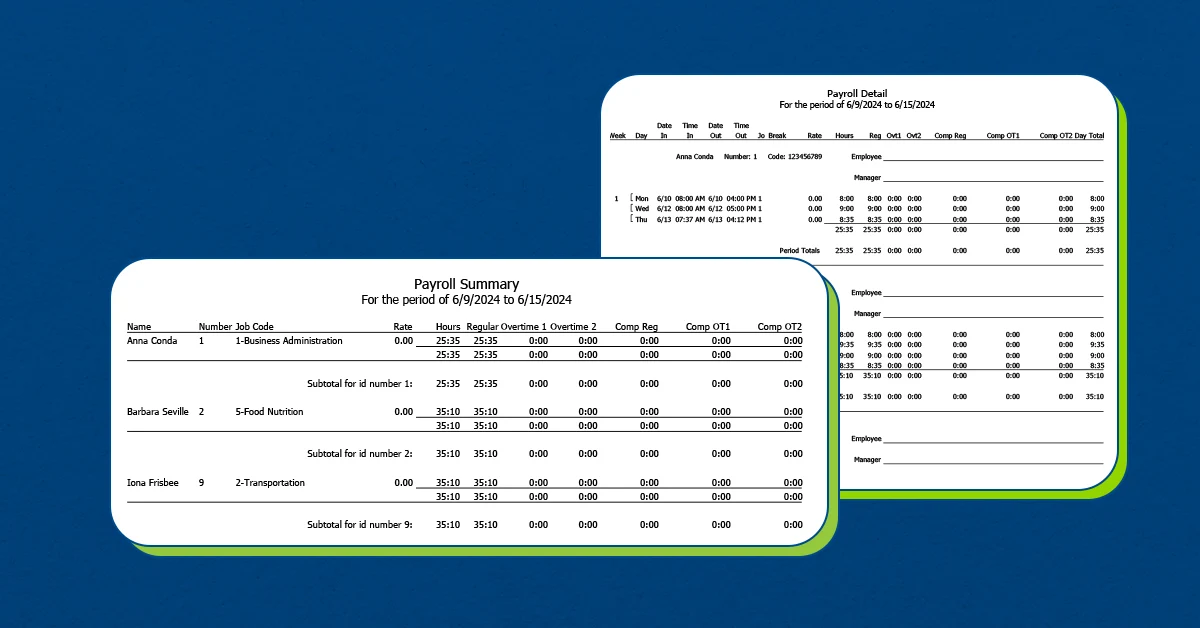

In practice, employee time tracking would happen in software that automatically calculates hours worked — these solutions factor in pay rates, locations, regulations, plus considerations like overtime pay and exceptions management.

Automating how you calculate work hours reduces:

- Time spent on manual inputs for pay, breaks, leave accruals, and overtime

- Data errors (and subsequent penalties) that manual entries might incur

- Total labor costs from tracking the process and fixing pay mistakes

We’ve covered how you can calculate employee hours worked and reviewed several time tracking methods. When you shift to time tracking software to streamline this process, you can realize these efficiencies for your organization.

TCP Software’s employee scheduling and time and attendance solutions have the flexibility and scalability to suit your business and your employees, now and as you grow.

From TimeClock Plus, which automates even the most complex payroll calculations and leave management requests, to Humanity Schedule for dynamic employee scheduling that saves you time and money, we have everything you need to meet your organization’s needs, no matter how unique. Plus, with Aladtec, we offer 24/7 public safety scheduling solutions for your hometown heroes.

Ready to learn how TCP Software takes the pain out of employee scheduling and time tracking? Speak with an expert today.